Payroll tax calculator 2023

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Discover ADP Payroll Benefits Insurance Time Talent HR More.

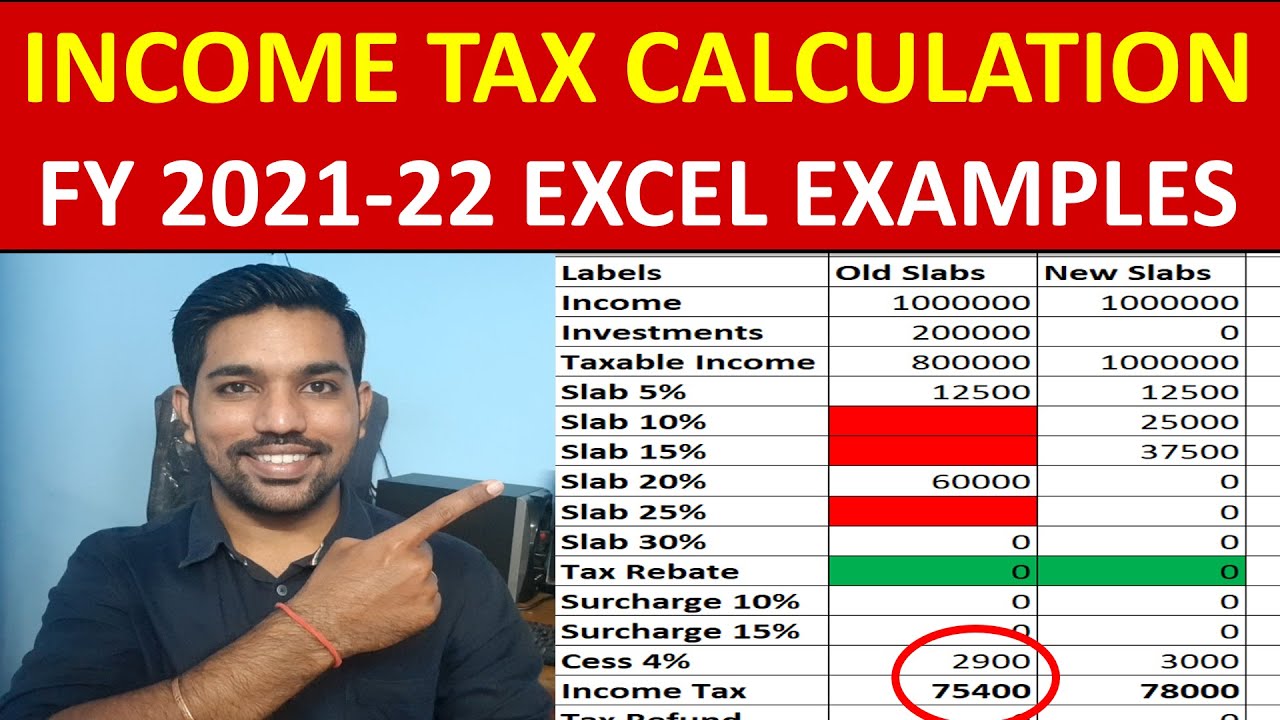

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Ad Payroll So Easy You Can Set It Up Run It Yourself.

. On the other hand if you make more than 200000 annually you will pay. Ad Process Payroll Faster Easier With ADP Payroll. Estimate your federal income tax withholding.

FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. How Income Taxes Are Calculated First we. Iowa also requires you to.

It can also be used to help fill steps 3 and 4 of a W-4 form. All Services Backed by Tax Guarantee. Free Unbiased Reviews Top Picks.

For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000 which. All Services Backed by Tax Guarantee. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Prepare and e-File your. 2022 Federal income tax withholding calculation. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

The maximum an employee will pay in 2022 is 911400. Get Started With ADP Payroll. For 2022-23 the rate of payroll tax for regional Victorian employers is 12125.

See how your refund take-home pay or tax due are affected by withholding amount. Ad Process Payroll Faster Easier With ADP Payroll. SARS Income Tax Calculator for 2023 Work out salary tax PAYE UIF taxable income and what tax rates you will pay.

Its so easy to. Sage Income Tax Calculator. For example if an employee earns 1500.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. In Iowa the rates for 2022 are between 0 and 75 of the first 34800 of taxable wages depending on the number of employees you have. Ad Payroll So Easy You Can Set It Up Run It Yourself.

For 2022 Wyoming unemployment insurance rates range from 009 to 85 with a taxable wage base of up to 2770000 per employee per year. It will be updated with 2023 tax year data as soon the data is available from the IRS. See where that hard-earned money goes - with UK income tax National Insurance.

And is based on the tax brackets of 2021 and. Free Unbiased Reviews Top Picks. The standard FUTA tax rate is 6 so your.

Ad Compare This Years Top 5 Free Payroll Software. 2023 payroll tax calculator Thursday September 8 2022 Edit. Georgia Paycheck Calculator 2022 - 2023.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment. Address Herschler Building East 122 W. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

If youre starting a new small. Ad Compare This Years Top 5 Free Payroll Software. If youve already paid more than what you will owe in taxes youll likely receive a refund.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan. This division is also responsible for all payroll tax reporting wage garnishments and child support withholdings. An updated look at the Chicago Cubs 2022 payroll table including base pay bonuses options tax allocations.

Subtract 12900 for Married otherwise. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Use our employees tax calculator to work out how much PAYE and UIF tax.

Well calculate the difference on what you owe and what youve paid. 5304 g 1 the maximum special rate is the rate payable for level IV of the Executive Schedule EX-IV. The EX-IV rate will be increased to 176300 effective the first day.

The Tax Calculator uses tax. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Calculate Your 2023 Tax Refund. Discover ADP Payroll Benefits Insurance Time Talent HR More. The first thing you need to know about the Georgia paycheck calculator.

The payroll tax rate reverted to 545 on 1 July 2022. How It Works. Get Started With ADP Payroll.

See your tax refund estimate. There is also a special payroll tax rate for businesses in bushfire affected local government. Use SmartAssets paycheck calculator to.

Calculate how tax changes will affect your pocket. Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Use this tool to.

Listentotaxman Uk Paye Salary Tax Calculator 2022 2023

Income Tax Calculator Apps On Google Play

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

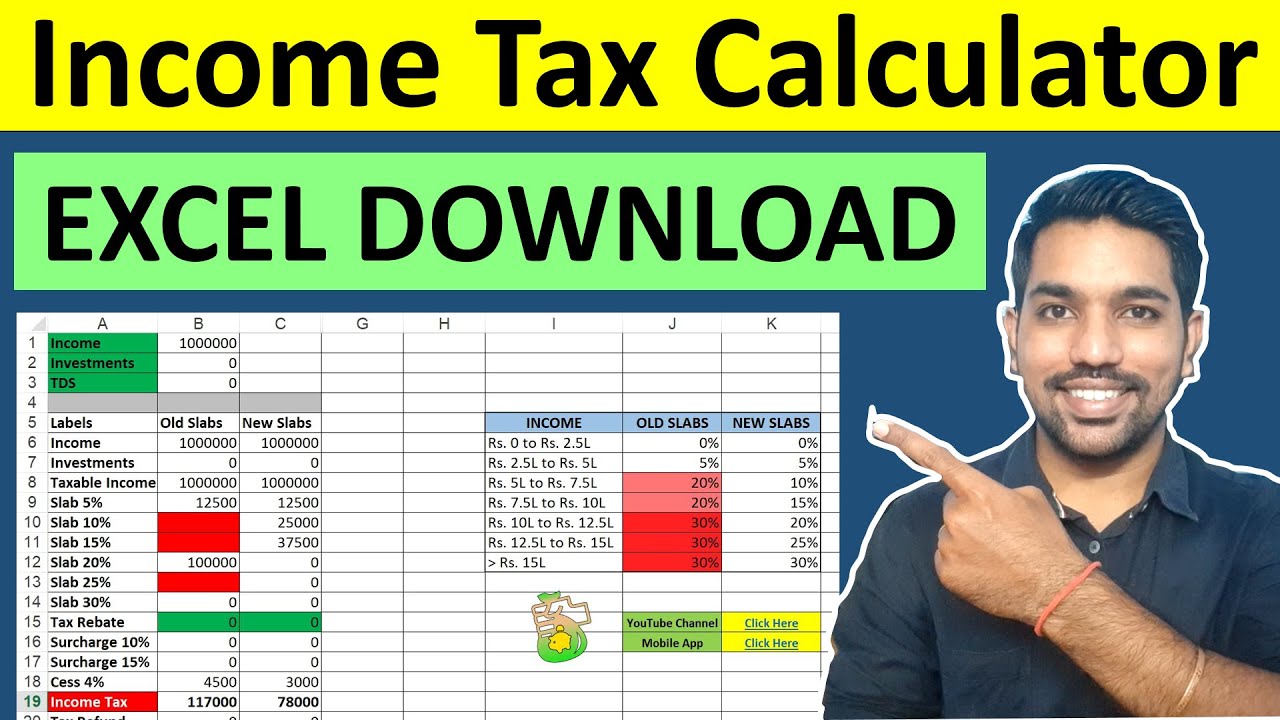

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

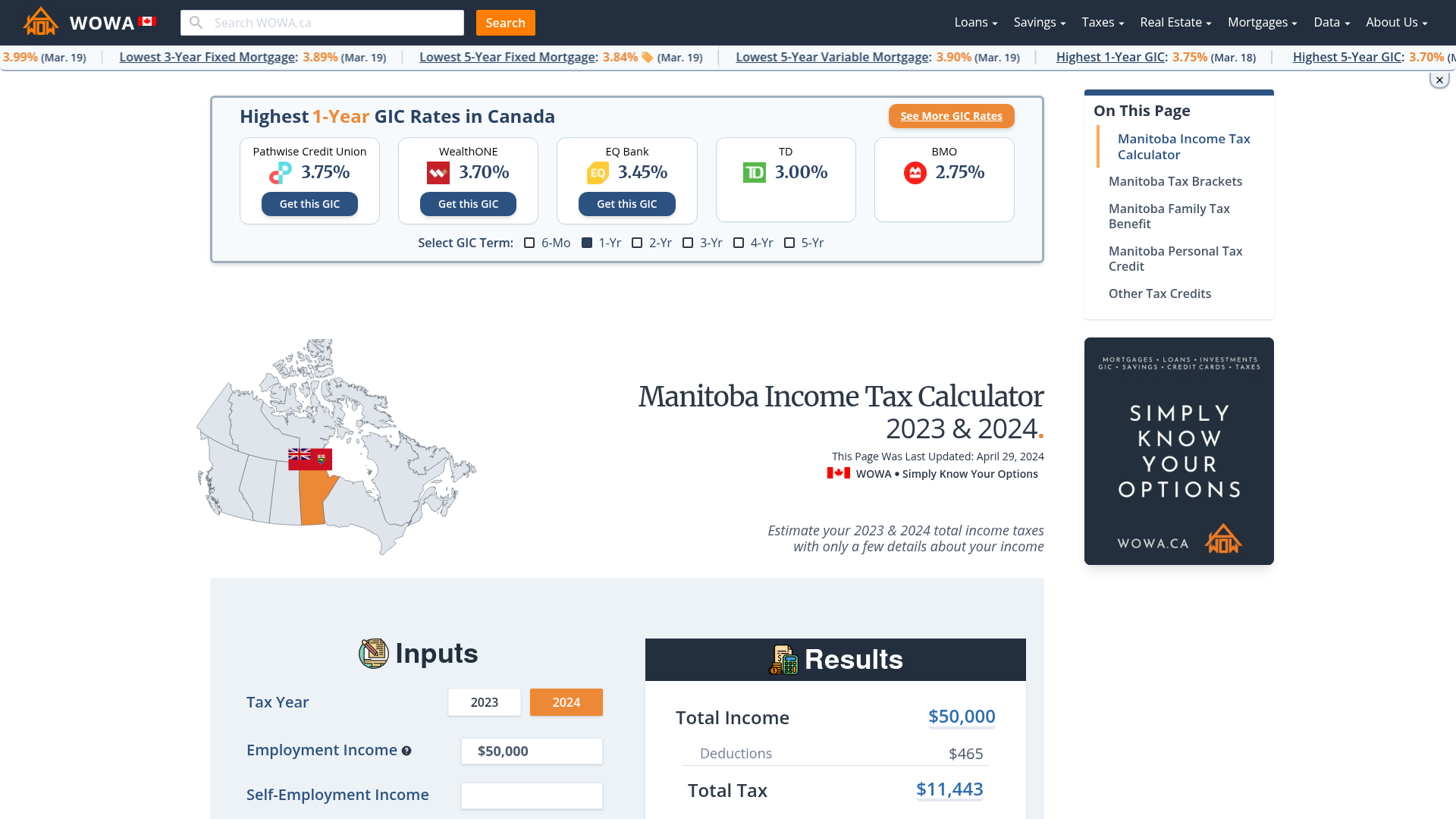

2021 2022 Income Tax Calculator Canada Wowa Ca

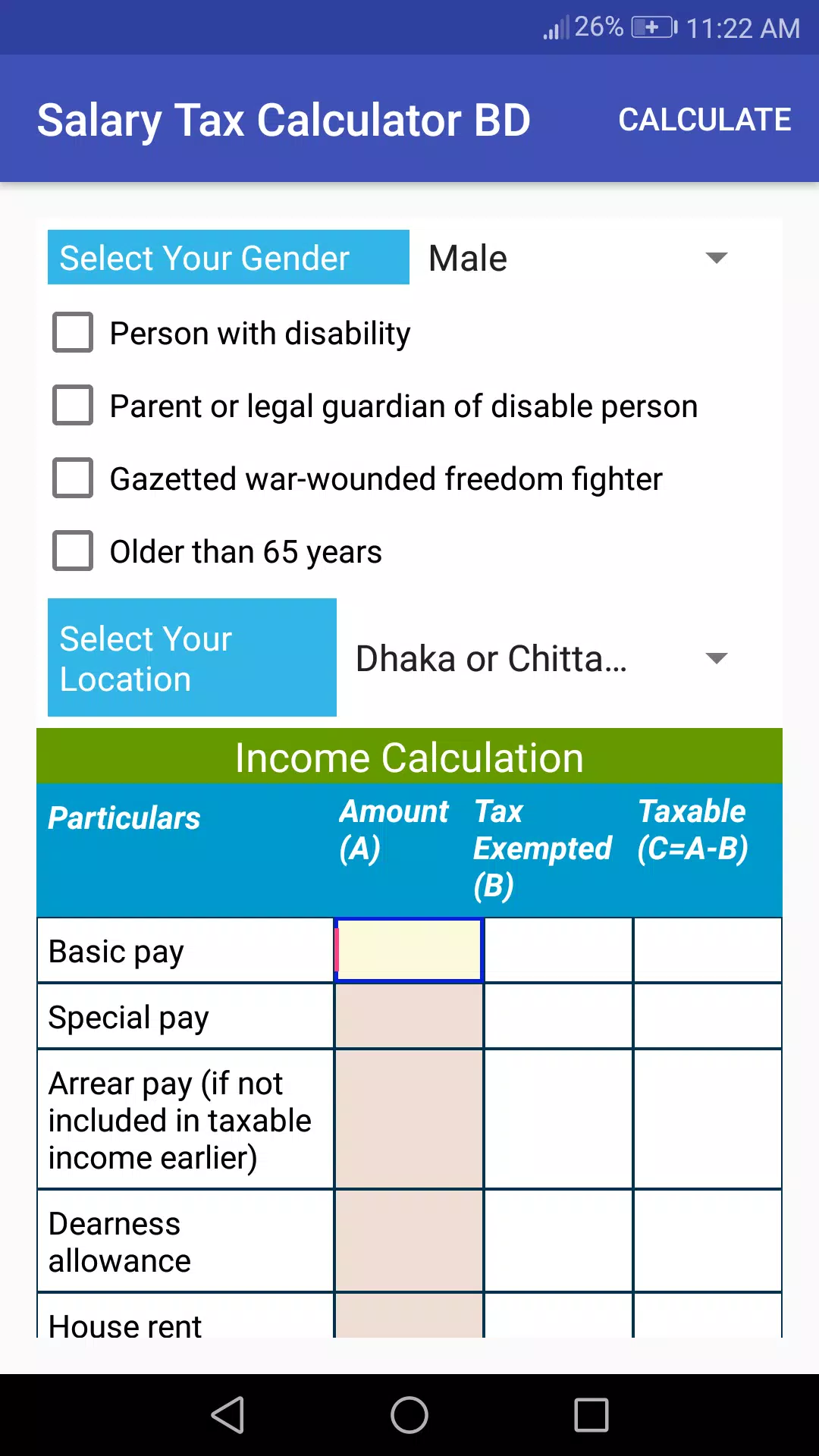

Salary Tax Calculator Bd Apk For Android Download

South Africa Tax Calculator 2022 2023 Calculate Your Tax For Free Youtube

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

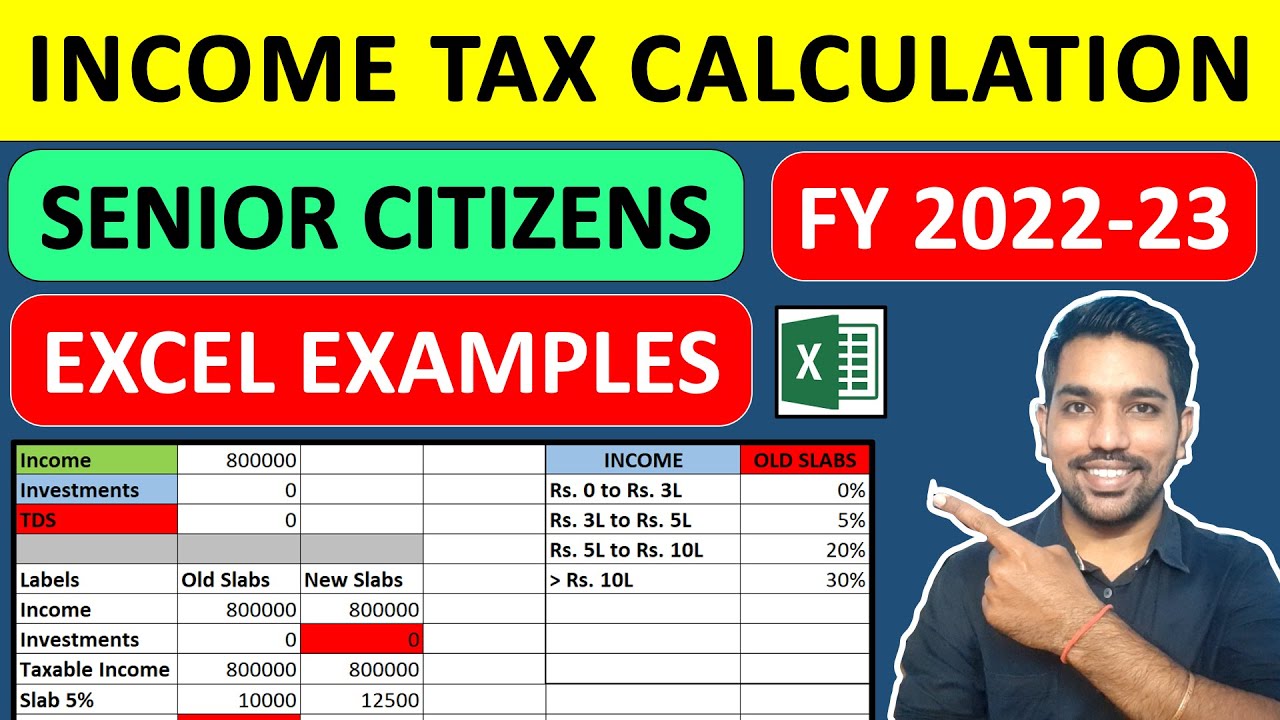

Senior Citizen Income Tax Calculation 2022 23 Excel Calculator Examples New Tax Slabs Tax Rebate Youtube

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Simple Tax Calculator For 2022 Cloudtax

H R Block Tax Calculator Services

H R Block Tax Calculator Services

How To Calculate Income Tax Fy 2021 22 New Tax Slabs Rebate Income Tax Calculation 2021 22 Youtube

Manitoba Income Tax Calculator Wowa Ca

![]()

Canada Income Tax Calculator 2022 With Tax Brackets Investomatica